DISCLAIMER: I AM NOT A FINANCIAL ADVISOR

Saving money can be difficult, especially when you’re living on a modest salary. But with some planning and smart choices, it is possible to save $10,000 a year even on a salary of $43,000. Which I was making in my teaching days. For context, I was a single woman in Charlotte, NC, the year was 2021, living in a 2 bedroom, 2 bathroom apartment. In this blog post, we’ll explore some practical tips and strategies that can help you achieve this goal.

- Create a Budget

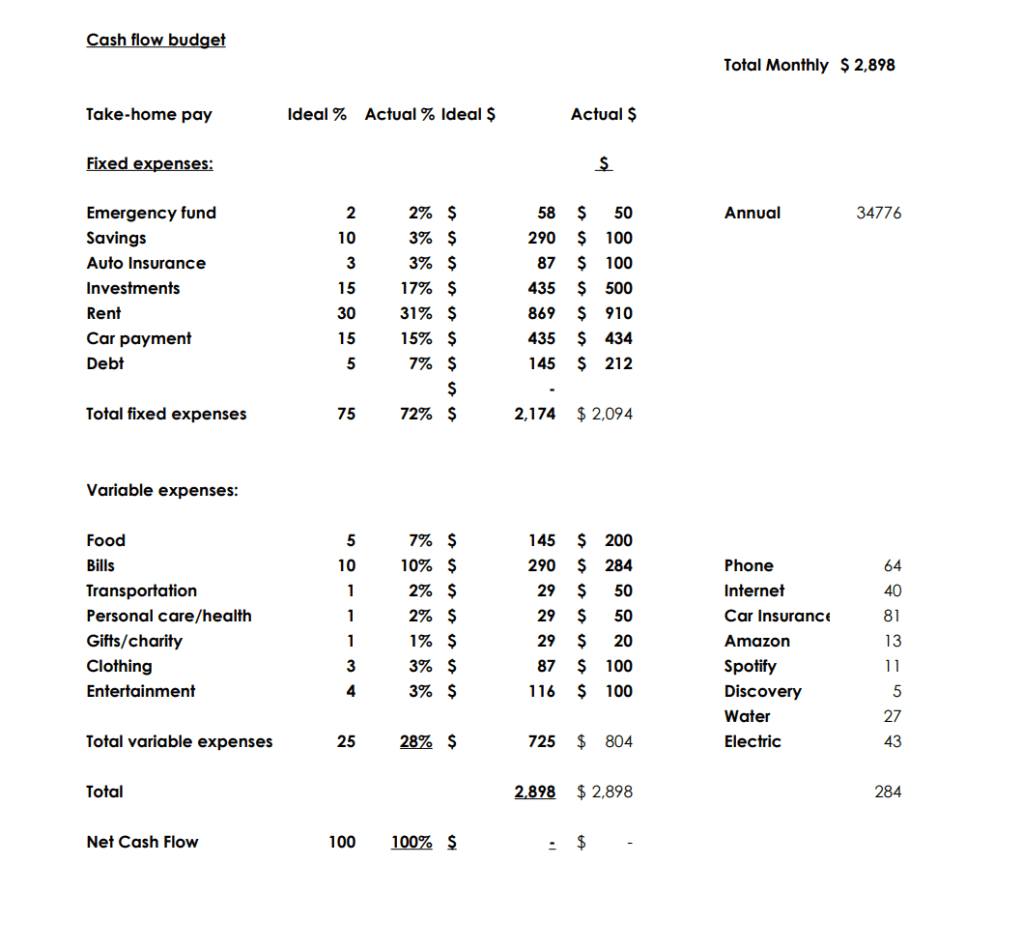

The first step to saving money is to create a budget. Dave Ramsey said it best, “Every dollar needs a name.” This involves tracking your income and expenses to determine where your money is going each month. Start by making a list of all your sources of income, including your salary, any side hustle income, and any government benefits you may be eligible for. I chose to solely use my teacher salary and got other jobs like grading papers or scoring applications to supplement any other goals. Mine was to save 10k a year.

List all your expenses, including rent or mortgage payments, utilities, groceries, transportation costs, and any other bills you have to pay. Once you’ve listed all your expenses, subtract them from your income to see how much money you have left over each month.

- Cut Down on Your Expenses

Now that you have a clear picture of your finances, it’s time to start cutting down on your expenses. Look for areas where you can save without sacrificing your quality of life. For example, you could switch to a cheaper phone plan or negotiate a better deal on your car insurance. At one point, my car insurance was 181 a month and switching saved me so much money. I even switched my phone plan from postpaid to prepaid at one point to avoid fees, and honestly, they are so much cheaper.

Cutting down on eating out and entertainment expenses can also help you save a significant amount of money. Notice you don’t see Netflix or Hulu on my budget. I would watch TV at a friend’s house if it was that deep. Tubi and Pluto were my best friends. And happy hour drinks taste just as good as drinks at 6 pm. Always pack your lunch, and opt for free or low-cost activities instead of expensive ones. Many city blogs have free activities around the city. Paint and Sip in the park, use city greenways, and shop at Marshall’s, Ross and TJ’s on clearance.

- Set Savings Goals

Once you’ve identified areas where you can save money, it’s time to set savings goals. A good rule of thumb is to aim to save 20% of your income each month. But it’s also important to be SMART, specific, measurable, achievable, realistic, and time-bound. So why 20% or why $10,000? For me:

Save $10,000 a year to contribute to a downpayment by the end of 3 years.

So to help me reach my savings goals I had separate accounts at different banks for my emergency account, savings account and investing account. Out of sight, out of mind. I put everything where it needed to go, and paid who need to get paid first. Because if it was on my debit card, it would be spent. I focused on having the best account with the best amenities aligned to that accounts purpose. If you look at my budget you’ll notice I stopped saving and started investing more, why? I didn’t need the cash and liked the returns in the market. And no none of this included retirement. And no a 403b is not investing, it’s retirement. It’s not saving, its retirement saving. That came out of my paycheck well before it got to me.

- Look for Ways to Increase Your Income

Another way to save more money is to increase your income. Look for opportunities to earn extra money, such as taking on a part-time job or freelance work. I preferred part-time remote work and this was even before the Pandemic. Instead of grading papers at night off the clock, I clocked into application scorer, test moderator, and tutoring. But to each their own. I know teacher friends who did Uber, Amazon, bartending whatever. The beautiful thing about teaching is most of us are off before five. And I say this with love. You are going to have to work hun. Stop trying to buy into some get-rich-quick, I’ll be my own boss bullshit. It’s a fast track to losing precious money and time. Even starting your own business requires work, if it doesn’t you are doing it wrong. I can’t tell you how many teachers tried selling me their candles, Herbal Life, Mary Kay or Shea Butter. Look for opportunities and markets outside of your school, but that utilize your skills.

- Avoid Debt

Debt can be a major barrier to saving money. If you have credit card debt or other loans, make it a priority to pay them off as soon as possible. This will free up more money for savings each month.

If you do need to take out a loan, make sure you understand the terms and conditions before signing up. Look for loans with low-interest rates and no hidden fees, and aim to pay them off as quickly as possible.

- Make Smart Investments

Investing your money can help you grow your wealth over time. Look for opportunities to invest in stocks, mutual funds, or real estate. Treasury bond rates go crazy at they time I am writing this. Make sure you understand the risks involved and seek professional advice if you’re unsure. And make sure they have the heart of a teacher and aren’t just a salesman.

Final thoughts

Saving $10,000 a year on a salary of $43,000 may seem like a daunting task, but with the right strategies, it’s achievable. By creating a budget, cutting down on your expenses, setting savings goals, increasing your income, avoiding debt, and making smart investments, you can build up your savings and achieve financial freedom.